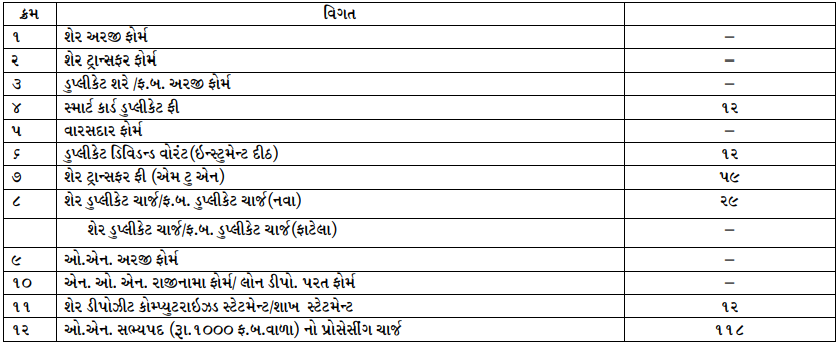

Rates of Banking Commission

Amount (Inclusive of GST) in Rs.

Share division charges Amount (Inclusive of GST) in Rs.

- Cash handling charges

Savings Account Holder:Savings holders will not incur any charges on the amount deposited for cash deposit transactions within a limit of Rs. In case of depositing more than Rs.Rs.Lakh in any month, there will be a charge of Rs.50/- + GST per lakh. other

Account holders:Holders of other accounts will not be charged any amount deposited for cash deposit transactions up to a total limit of Rs.15 lakhs in 1 month (English month). Charge Rs.50/- + GST per lakh in case of cash deposit exceeding Rs.15 lakh in any month. Average

Released based on balance:An average balance of Rs.1 lakh or more is maintained in the account during the preceding (last completed) month to deposit an additional Rs.2,50,000/- per Rs.1 lakh (proportionate net) of the balance maintained by the away rate per month. will be exempted from charge.

The computer software will execute daily and credit the charge account. Monthly branch calculated, this charge has to be deposited to the owner.

- Solvency Certificate Charges:The commission amount in the solvency certificate shall be charged by the branch as determined by the bank from time to time. Which is currently Rs. 118/- per lakh (inclusive of GST).

- Debit card charges:Platinum Contactless CardA tax charge of Rs.25/- per card per annum is levied by NPCI so from the second year the customer will be charged an annual charge of Rs.25/- per card. This charge will be waived if the customer makes online transactions (POS/eCom) of Rs.50,000/- or more during the last 12 months.